Using Trading Central's "Economic Insight" investors can check out up-coming major economic data.

We are looking into the trading week of April 15 - 19:

We can select economic data of "High", "Medium" or "Low" importance, or any combination of such filters:

We can select which economies to focus on:

China's exports slumped 7.5% on year in March with imports unexpectedly shrinking 1.9%.

It is a setback for the country, which keeps implementing favorable policies with an aim to gear up an economic recovery.

Market participants should then closely watch China’s gross domestic product (GDP) data due Tuesday (April 16), seeking clues if China would further boost liquidity to support markets.

According to Trading Central's "Economic Insight", China’s GDP Growth may slow to 5.0% on year in the first quarter from 5.2% in the prior quarter.

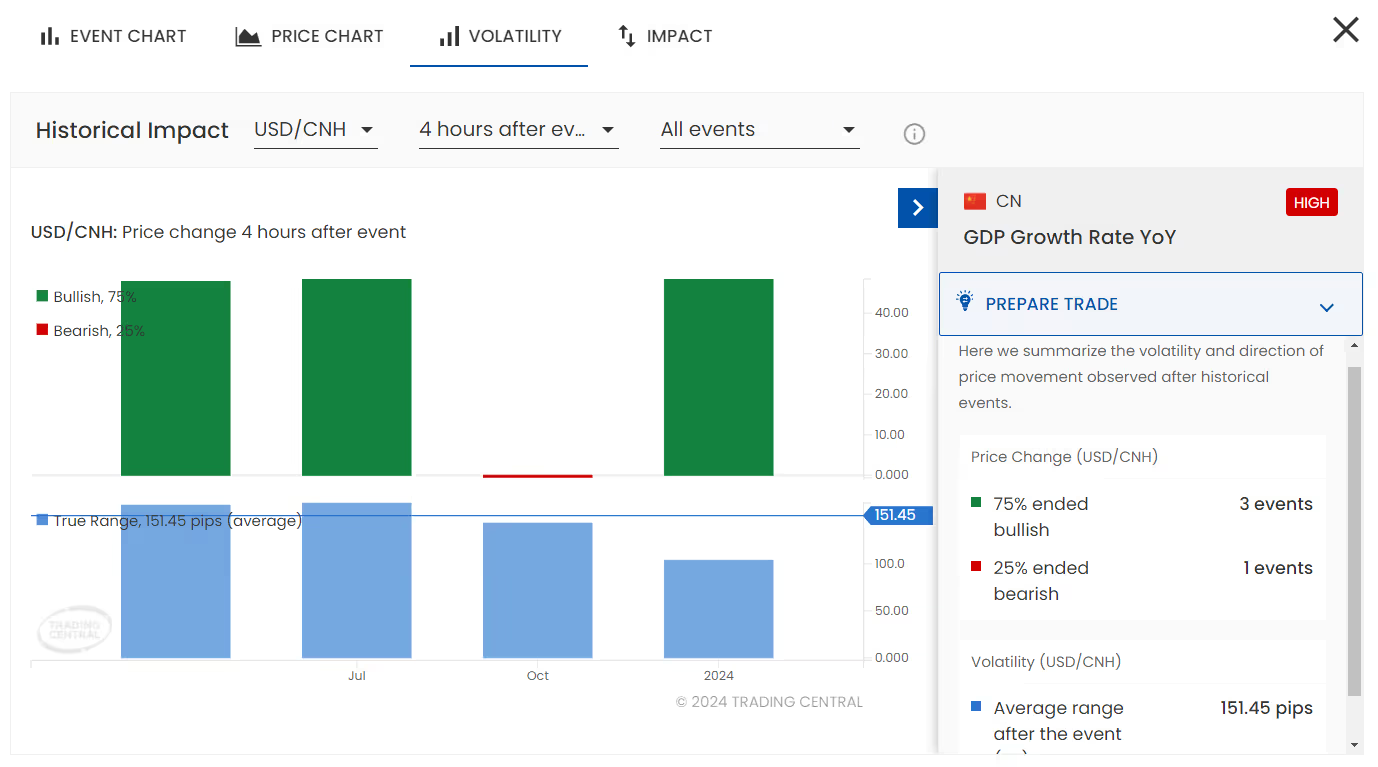

In the past four China GDP Growth Reports,USD/CNH rose in 75% of times (3 out of 4 events) within one hour from the report’s release, marking a trading range of 151.45 pips on average.

Key Economic Data Forecasts:

Monday (April 15)

JP Machinery Orders (FEB) -0.2% MoM

EA Industrial Production (FEB) +1.1% MoM

US NY Empire State Manufacturing Index (APR) may improve to -10.0

US Retail Sales (MAR) +0.4% MoM

Tuesday (April 16)

CN GDP Growth (Q1) expected to slow to 5.0% YoY

CN Industrial Production (MAR) +5.3% YoY

CN Retail Sales (MAR) +3.4% YoY

DE ZEW Economic Sentiment Index (APR) to rise to 32

GB Unemployment Rate (FEB) to rise to 4%

US Building Permits (MAR) -0.7% MoM

US Housing Starts (MAR) -0.8% MoM

US Industrial Production (MAR) +0.2% MoM

CA Inflation Rate (MAR) may dip to 2.7% YoY

Wednesday (April 17)

NZ Inflation Rate (Q1) expected to slow to 4.3% YoY

JP Trade Deficit (MAR) may narrow to 280 billion yen

GB Inflation Rate (MAR) to slow to 3.1% YoY

Thursday (April 18)

AU Unemployment Rate (MAR) to climb to 4.0%

AU Employment (MAR) may decrease 70,000

US Philadelphia Fed Manufacturing Index (APR) may rise to 3.8

US Initial Jobless Claims (APR/13) may tick up to 212,000

US Existing Home Sales (MAR) -2.2% MoM

US Conference Board Leading Index (MAR) +0.1% MoM

Friday (April 19)

JP Inflation Rate (MAR) expected to remain stable at 2.8% YoY

JP Core Inflation Rate (MAR) may rise to 0.1% MoM

GB Retail Sales (MAR) +0.2% MoM

DE Producer Prices (MAR) -4.2% YoY

Happy Trading!

Source: Trading Central Economic Insight